Home > Resources > Newsletters > BFSI Vue

1st August 2024

AI and APIs in insurance land

The first fully automated insurance underwriting process released 50% of all non-medical cases totally on its own, without any manual intervention.

1986 was the year underwriting in insurance was first automated completely. The Mutual Life Insurance Company of New York developed the rules-based logic engine Comprehensive Life Underwriting Expert System (CLUES) to deeply analyze all the inputs that were provided about a policy and its prospective holder, simulating the decision-making processes of experienced underwriters. Some 800 rules and 8000 steps later, a decision to either accept the application or refer to a Human-in-the-loop for further review was taken. During the first year, the system was able to release 50% of all non-medical cases totally on its own without any manual intervention. The Mutual Life Insurance Company of New York increased underwriting capacity without increasing the size of the underwriting team.

By 2021, 91% of life insurers had fully or partially-automated underwriting programs in place, up from 62% in 2019, per Limra, an insurance industry research firm. Life insurers surveyed by McKinsey & Co. in 2020 saw a 14% median increase in sales volume within two years of digitizing certain aspects of their services, including underwriting. Today, driven by AI, insurtech is at the cusp of another inflection point in its growth trajectory that’s hurtling towards increased productivity and efficiency.

So, what's our role here?

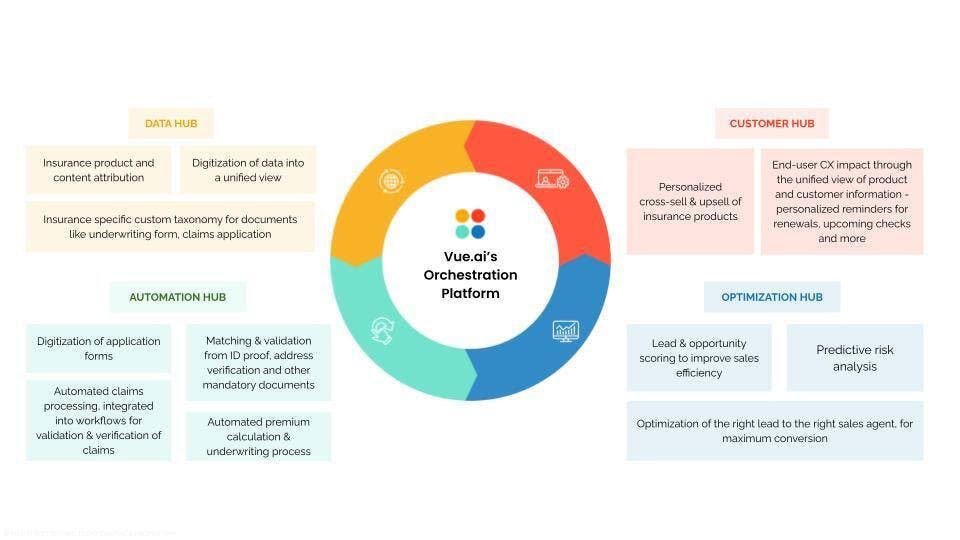

An orchestration platform that aims to uncomplicate AI for enterprises, Vue.ai equips three broad categories of stakeholders in large BFSI orgs: ▶ Data teams (in unlocking cost-effective platform capabilities) ▶ ML teams (that help build and deploy a wide range of models) ▶ Business teams (to automate a variety of workflows). Vue.ai places a suite of features across four key hubs – Data, Automation, Customer, and Optimization – at your disposal

Data Hub: Centralizing, standardizing insurance data

- Product and content attribution: If systematic attribution and organization of products and content is a key building block of the insurance business, the Vue.ai platform enables users to do it with minimal effort. Since the data labeling is consistent and easily accessible, retrieval and overall management becomes easier.

- Digitization into a unified view: Breaks down data silos and enables across-the-board access and analysis. Insurance teams gain a panoramic perspective of all related information on the Vue.ai platform.

- Insurance-specific custom taxonomy for documents: Locating and processing essential documents becomes easier when categorization is standardized. Vue.ai’s custom taxonomy that’s specifically tailored for insurance documents such as underwriting forms and claims applications was designed with this in mind.

Automation Hub: Enhancing efficiency through technology

- Digitization of application forms: Slashed – Manual data entry. Shortened – Processing times. Digitizing documents with dexterity, the Automation Hub transforms tedious, time-consuming tasks into efficient, error-free workflows. A form-idable platform, we like to call it.

- Claims processing: Vue.ai integrates automated claims processing into existing workflows, ensuring that validation and verification of claims are handled swiftly and accurately. Benefits? Reduces the time and effort required to process claims, leading to faster resolutions for customers.

- Matching & Validation from ID Proof: Compliance to regulations needn’t be complicated. The AI platform automates the matching and validation of ID proof, address verification, and other mandatory documents, reliably ensuring compliance with requirements and enhancing the accuracy of the verification process.

- Premium calculation & underwriting process: When premiums are calculated by triangulating multiple parameters, calculations get granular and precise, improving the overall operational efficiency of the underwriting process. Schedule with us a demo, to see if it matches your expectations.

Vishal Subharwal, CMO - HDFC Life and Aditya Agrawal discuss how AI can drive substantial growth for the BFSI sector and how embracing a future-forward mindset can set the stage for transformative success. Excerpted from REBUILD '24 Istanbul, Vue.ai's flagship AI transformation meet-up with 75+ business and technology leaders.

Customer Hub: Personalizing customer interactions

- Personalized cross-sell & upsell of insurance products: Vue.ai's Customer Hub leverages advanced algorithms to provide personalized recommendations for cross-selling and upselling insurance products. This targeted approach increases customer satisfaction and drives revenue growth.

- End-user customer experience (CX) impact: By offering a unified view of product and customer information, Vue.ai enhances the end-user CX. Personalized reminders for renewals, upcoming checks, and more ensure that customers are engaged and informed, leading to higher retention rates.

Optimization Hub: Maximizing Sales and Mitigating Risks

- Lead & Opportunity Scoring to Improve Sales Efficiency: The Optimization Hub utilizes predictive analytics to score leads and opportunities, enabling sales teams to prioritize their efforts on high-potential prospects. This improves sales efficiency and conversion rates.

- Predictive Risk Analysis: Vue.ai's predictive risk analysis tools help insurers identify and mitigate potential risks. By analyzing historical data and trends, the platform provides actionable insights to make informed decisions and reduce risk exposure.

- Optimization of the Right Lead to the Right Sales Agent: The platform optimizes the assignment of leads to the most suitable sales agents, ensuring maximum conversion potential. This intelligent matching process boosts agent productivity and enhances customer satisfaction.

Tapping into the power of automation, data centralization, customer personalization, and optimization, Vue.ai empowers insurance companies to operate more efficiently, deliver superior customer experiences, and drive business growth. Vue.ai's domain-specific, preset use cases and the capability to spin up new use cases through its four hubs position customers for success in their data-driven AI transformation journeys.

How other industries are transforming business processes, using AI

More AI leaders shared their expertise at REBUILD ‘24 Istanbul. Tune in.

- How Vivienne Chan reduced the PDP creation process from days to minutes.

- Arjun Sarkar, Senior Director of Digital Solutions, Dubai CommerCity on shifting to paperless ID-ing via Vue.ai’s Intelligent Document Processing approach.

- Dr.Ahmad Darwish, Head of Digital Delivery, Bank Albilad highlighted the predictive analytical ability of AI as an early warning signal for loan recovery.

Robust risk management and secure operations are essential not only for protecting a bank’s assets but also for maintaining customer trust and confidence, argues Mohamed Roushdy, Senior Consultant, International Finance Corporation at REBUILD '24 Istanbul.

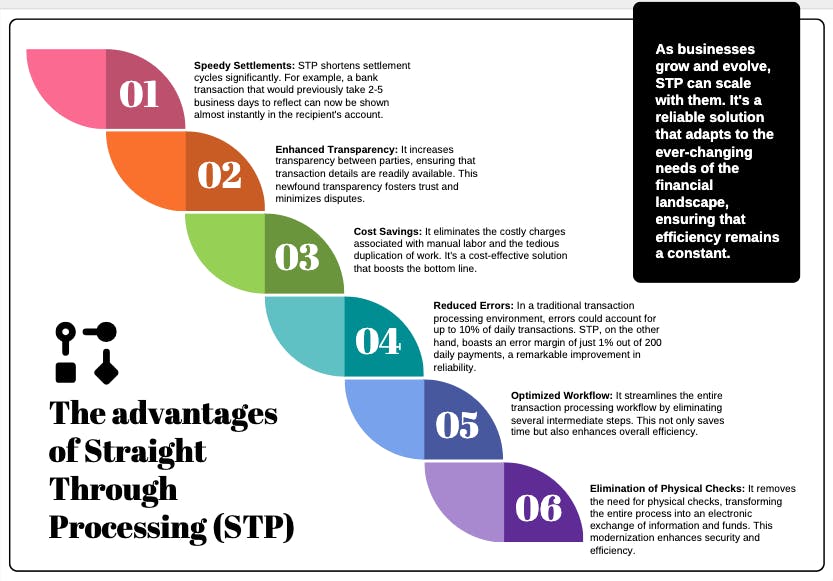

Straight Through Processing (STP) is transforming the insurance, finance, and banking industries by automating document processing, reducing errors and accelerating transaction times. Dive into these use cases and learn how STP enhances efficiency, ensures accuracy, and boosts customer satisfaction.